Adhering to strict industry standards compliance in car title loans is crucial for protecting borrowers and lenders. This involves rigorous inspections, financial assessments, flexible repayment plans, clear fee communication, secure data handling, and regulatory oversight by government bodies. Regular audits maintain fair practices, detect risks, and foster trust, empowering borrowers to make informed decisions while promoting responsible lending.

In the dynamic landscape of the car title loan industry, adhering to stringent compliance standards is paramount. This article delves into the crucial aspects that audits scrutinize, highlighting key compliance areas, regulatory oversight mechanisms, and consumer protection measures. By exploring these elements, we uncover the essential role of audits in maintaining the integrity of car title loan practices, ensuring both fair lending and financial security for borrowers across the industry.

- Key Compliance Areas in Car Title Loans

- Regulatory Oversight and Compliance Standards

- Ensuring Consumer Protection Through Audits

Key Compliance Areas in Car Title Loans

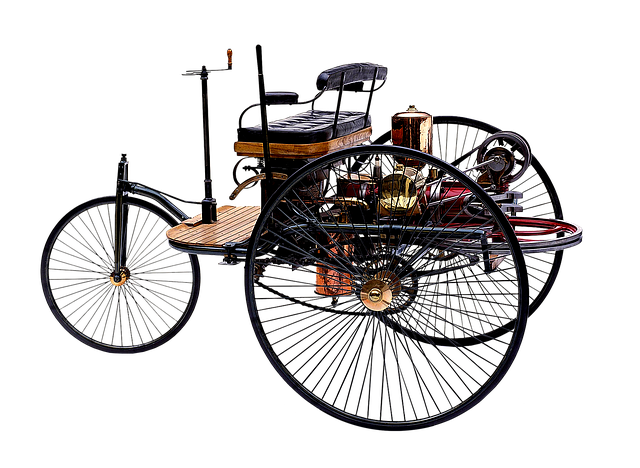

In the car title loan industry, ensuring compliance with established standards is paramount to protecting both lenders and borrowers. Several key areas require meticulous attention to maintain fairness and transparency in this specialized lending sector. These include thorough vehicle inspection processes that evaluate a vehicle’s condition, value, and potential hidden defects, thereby mitigating risk for both parties. Additionally, lenders must rigorously assess borrowers’ financial health and ability to repay the loan, often offering solutions like flexible repayment plans tailored to individual circumstances, especially in cases of bad credit loans.

Beyond these, compliance involves adhering to regulations related to interest rates, loan terms, and collection practices. Lenders must clearly communicate all fees and charges associated with the car title loan, ensuring borrowers understand the full cost of borrowing. Furthermore, maintaining secure data handling practices is crucial, especially when processing sensitive personal and financial information. These measures collectively contribute to a robust car title loan industry standards compliance framework that fosters trust and responsible lending.

Regulatory Oversight and Compliance Standards

The car title loan industry operates within a framework of stringent regulatory oversight and compliance standards designed to protect consumers and ensure fair lending practices. These regulations are implemented by various government bodies, each playing a crucial role in monitoring and enforcing industry standards. Lenders must adhere to strict guidelines covering loan requirements, including interest rates, repayment terms, and fees. An integral part of this process involves the use of vehicle collateral, where borrowers offer their vehicles as security for the loan.

Compliance standards also dictate how lenders handle customer applications, such as the online application process. This digital approach has made accessing car title loans more convenient but underscores the importance of maintaining robust data security and privacy measures to safeguard sensitive personal information. Effective compliance not only ensures the financial well-being of borrowers but also fosters transparency and trust in the industry.

Ensuring Consumer Protection Through Audits

In the car title loan industry, ensuring consumer protection is paramount to maintaining fair and transparent practices. Regular audits play a pivotal role in upholding compliance with industry standards and safeguarding borrowers’ interests. These thorough evaluations scrutinize various aspects of loan agreements, terms, and conditions to guarantee that lenders adhere to the necessary legal frameworks and ethical guidelines. By examining documentation, procedures, and internal controls, auditors identify potential risks and vulnerabilities, ensuring that consumers are not exploited through predatory lending practices.

Audits also facilitate the detection of any irregularities or misconduct related to title transfers, emergency funds, or title pawns—key components in this industry. They verify that these transactions are conducted securely, with proper documentation and disclosure, protecting both lenders and borrowers from fraudulent activities. Through proactive consumer protection measures, audits foster a trustworthy environment, encouraging responsible lending while empowering borrowers to make informed decisions.

Audits play a pivotal role in maintaining the integrity of the car title loan industry by ensuring adherence to established compliance standards. By thoroughly reviewing key areas such as loan documentation, interest rates, and collection practices, these audits safeguard consumers from exploitative lending practices. Regulatory oversight and the implementation of robust consumer protection measures are essential for fostering trust and transparency within the car title loan market, ultimately promoting fair and ethical lending across the industry.