The car title loan industry standards are crucial guidelines that protect lenders and borrowers through fair lending practices with transparent terms. Compliance is vital to prevent predatory lending, ensuring clear communication of interest rates, repayment schedules, and penalties in simple language. It benefits lenders by reducing legal risks, maintaining reputations, and fostering trust. This is especially important for individuals seeking quick financing, as compliance allows for flexible payment plans while adhering to legal boundaries. Non-compliance poses significant risks, impacting both lenders and borrowers negatively, emphasizing the need for adherence to maintain fairness, transparency, and trust in this alternative financing sector.

In the dynamic landscape of alternative lending, car title loans stand out as a significant segment of the financial services sector. Compliance checks play a pivotal role in ensuring the integrity and fairness of this industry. This article delves into the essence of understanding the car title loan industry standards and their profound impact on both lenders and borrowers. By examining compliance’s critical function, we uncover how it fosters ethical lending practices, mitigates risks, and safeguards consumer rights in the fast-paced world of car title loans.

- Understanding the Car Title Loan Industry Standards and Their Significance

- The Role of Compliance Checks in Ensuring Fair Lending Practices

- How Non-Compliance Can Impact Lenders and Borrowers Alike

Understanding the Car Title Loan Industry Standards and Their Significance

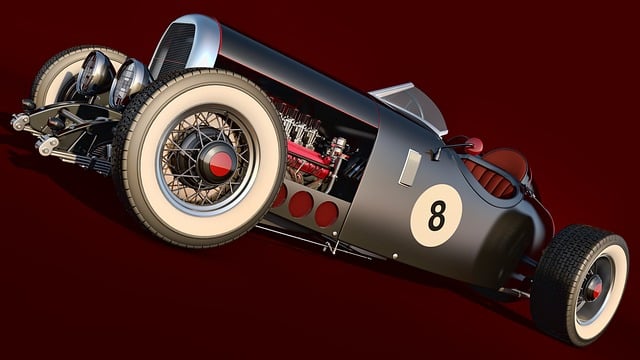

The car title loan industry standards are a set of crucial guidelines designed to protect both lenders and borrowers. These standards ensure that loans are extended fairly, with transparent terms and conditions. Compliance with these regulations is vital as it safeguards consumers from predatory lending practices, ensuring they receive a clear understanding of interest rates, repayment schedules, and potential penalties. For instance, many states mandate disclosure of loan terms in simple language, allowing borrowers to make informed decisions.

Adhering to industry standards also facilitates smooth operations for lenders. It reduces the risk of legal issues and reputational damage by avoiding violations that can arise from non-compliance. Moreover, these standards promote a culture of integrity within the industry, fostering trust between lenders and borrowers. This is particularly important in the car title loan sector, where individuals often turn to quick financing options. By maintaining compliance, lenders can offer flexible payment plans (including alternative arrangements like extended repayment periods) while adhering to legal boundaries, thus providing a safety net for both parties.

The Role of Compliance Checks in Ensuring Fair Lending Practices

Compliance checks play a pivotal role in upholding fair lending practices within the car title loan industry standards. These meticulous processes ensure that every step of the loan application and approval process adheres to legal and ethical guidelines, protecting both lenders and borrowers. By verifying the authenticity of documentation, such as proof of income and vehicle inspection reports, compliance checks mitigate risks associated with fraudulent activities. This is particularly crucial in the car title loan industry, where the value of collateral (the vehicle) is central to the transaction.

Beyond ensuring transparency, these checks promote equality by preventing discriminatory lending practices. They ensure that borrowers receive accurate information about interest rates, repayment terms, and potential penalties, facilitating informed decision-making. Moreover, compliance ensures that lenders maintain accurate records, which can help in dispute resolution processes for both parties, including those seeking quick approval for semi truck loans or other vehicle types. This holistic approach fosters trust and encourages a robust car title loan market where all participants are treated fairly.

How Non-Compliance Can Impact Lenders and Borrowers Alike

Non-compliance in the car title loan industry can have detrimental effects on both lenders and borrowers. For lenders, non-adherence to established standards and regulations can lead to significant legal consequences, including heavy fines, licensing revocations, and even criminal charges. This not only damages their reputation but also puts their financial stability at risk. Moreover, non-compliance may result in a loss of customer trust, which is pivotal for the long-term success of any lender in this competitive market.

Borrowers, on the other hand, face their own set of challenges when lenders fail to meet industry standards. Inaccurate or incomplete loan approval processes can lead to delays in receiving funds, causing financial strain and preventing borrowers from achieving their intended goals, such as debt consolidation. Furthermore, non-compliance may expose borrowers to unfair practices, higher interest rates, and hidden fees, making it even harder for them to repay the loans on time. Ensuring compliance across all aspects of car title loan operations is thus crucial for maintaining fairness, transparency, and trust in this alternative financing sector.

Compliance checks are not just recommended, but essential for the smooth operation of car title loan businesses. By adhering to industry standards, lenders can ensure fair lending practices and protect both themselves and borrowers from potential legal pitfalls. Non-compliance can lead to significant consequences, including reputational damage, financial losses, and regulatory penalties. Therefore, integrating robust compliance measures into car title loan operations is a critical step towards maintaining ethical business practices and fostering trust in the industry.